Greetings from Classic Associates! Tuticorin

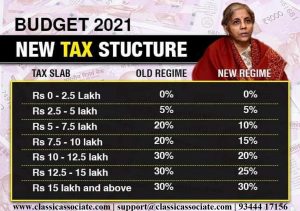

The Finance minister, in her speech on Budget 2021, did not announce any change in the rate of income tax. This year, there is no shift in income tax slabs. However, some measures have been announced to make filing a tax return even easier for small taxpayers.

For senior citizens, 75 years or above, with only pension and interest income are exempted from filing the tax returns. Tax audit limit for NRI has been increased from 5 crores to 10 crores. The government has also proposed to constitute a dispute resolution committee to improve transparency, accountability for small taxpayers.

Income tax slabs announced in Budget 2021:

1. 0 – 2.5 lakh – Exempted

2. Rs 2.5 lakh – Rs 5 lakh – 5%

3. Rs 5 lakh – Rs 7.5 lakh – 10% (20% earlier)

4. Rs 7.5 lakh – Rs 10 lakh – 15% (20% earlier)

5. Rs 10 lakh to Rs 12.5 lakh – 20% (30% earlier)

6. Ra 12.5 lakh – Rs 15 lakh – 25% (30% earlier)

7. Rs 15 lakh and above – 30%

The new tax rates are optional and are applicable for those foregoing exemptions and deductions.

We would love to hear from you and provide you with full assistance.

Follow us for more updates www.classicassociate.com | support@classicassociate.com | 93444 17156

Auditing Office at : Tuticorin (HO) | Coimbatore (BO) | Chennai (BO)

————————————————————————————————-

Budget 2021 Highlights | Union Budget 2021 | Income Tax Slab | Budget 2021 India | budget 2021 announcement